- HashBlock Capital

- Posts

- Worldcoin's Market-Making Agreements: A Structural Catalyst

Worldcoin's Market-Making Agreements: A Structural Catalyst

Market makers have a huge incentive to push the price of WorldCoin higher into the agreement expiry date.

Hashblock Capital is an independent Crypto research firm. We deliver actionable, institutional-grade analysis across listed tokens.

Follow us on Twitter for more insights, or join our email list to get real-time analysis on catalysts, events, and flows.

TLDR;

Worldcoin's predatory tokenomics and questionable business model have made it a target for short-sellers, who are betting that the price of $WLD will fall. As a result, over $50 million in short positions have been built up in the token.

Market-making agreements are set to expire at call prices significantly higher than the current price. This provides a massive incentive to push the market higher into the agreement expiry date - October 24th.

In this context of consensus short positioning and a structural catalyst, we believe that $WLD could push higher in the coming weeks leading up to the October 24th agreement expiry. If short-sellers are forced to cover their positions, this could lead to a major medium-term squeeze.

Introduction

WorldCoin is a new digital identity platform that aims to provide everyone on Earth with a free and secure way to prove their identity. The project is backed by a team of experienced entrepreneurs and technologists, including Sam Altman, the CEO of OpenAI, and Alex Blania, the former CTO of Coinbase.

To create a WorldCoin identity, users must scan their iris with a special device. This creates a unique and irreversible identifier that is then used to create a digital wallet. WorldCoin tokens can be received and spent using this wallet.

Worldcoin: Proof of personhood

WorldCoin had a controversial launch, and the backlash has been swift and severe. Critics accuse the project of being a scam, a surveillance state, and a threat to privacy. Notably, in a blog post titled What do I think about biometric proof of personhood?, the founder of Ethereum - Vitalik Buterin, raised concerns about the project and outlined several risks surrounding participation. These risks include:

Privacy: WorldCoin's iris scanning system could be used to track and surveil users.

Accessibility: WorldCoin will be inaccessible to people in developing countries who do not have access to Orbs.

Centralization: The Foundation has too much power over the system.

Security: The iris scanning system could be hacked or manipulated.

Outside of these factors, WorldCoin's tokenomics model has come under attack, with critics saying it is designed to benefit the project's founders and investors at the expense of users. They argue that the high inflation rate and the fact that the WorldCoin team controls a large percentage of the token supply will dilute the value of the token over time, making it worthless for users.

Tokenomics

One of the biggest criticisms of WorldCoin is its tokenomics. The project launched with only 100 million tokens in circulation, out of a total supply of 10 billion. This means that the team and investors control the vast majority of the tokens, and the community has very little control.

$WLD Unlock Scedule. Source: Whitepaper

Additionally, the team's tokens vest over three years, becoming fully vested by July 2026, while the community's tokens vest over 15 years. This gives the team a significant incentive to sell their tokens early ahead of their users and could act as a longer-term drag on price appreciation.

Inflation

Supply and demand are the two main factors that determine the price of a cryptocurrency. During bull markets, demand is the primary driver of price changes. When demand increases, the price rises. During bearish periods, demand decreases, and the price falls.

However, many people mistakenly believe that supply is fixed in crypto. This is not the case. Supply can fluctuate, and it is important to understand how this can affect the price of a cryptocurrency.

If a project has a high supply, or if the supply is increasing rapidly, it is more likely to experience price volatility. This is because there is more supply available, and less demand is needed to move the price.

This increase in supply is known as the token inflation rate. To illustrate its importance, consider the following example:

If a cryptocurrency has a supply of 100 million tokens and the demand for the cryptocurrency increases, it will take less demand to move the price of the cryptocurrency from $1 to $2 than it would if the cryptocurrency had a supply of 1 billion tokens.

Therefore, it is important to consider the upcoming supply of a token when making investment decisions. Cryptocurrencies with a high supply or a rapidly increasing supply may be more likely to experience price volatility.

$WLD Liquid Supply Curve. Source: Whitepaper

Worldcoin’s 12-month forward-looking inflation rate is 1,044.8%. Over the next 12 months, a total of 1.36bn $WLD tokens are set to hit the market, with a current circulating supply of 130m. At current prices, this would require USD inflows of $2,265,600,000 over the next 365 days, or just over $6.2m per day for the $WLD price to remain constant.

This level of token inflation is almost entirely unprecedented, with the runner-up in this metric, $DYDX, printing ‘just’ 262.1% for the same period.

Sentiment

Because Worldcoin's tokenomics are similar to those of low-float, Alameda-backed projects like SRM, MAPS, and RAY which slowly marched towards a terminal value of $0, selling $WLD has become one of the most consensus trades.

Hedge funds and even venture firms are leaning on the short side in $WLD as a hedge against the wider market, and this has led to a sharp decline in price since Binance launched perpetual futures in July 2023.

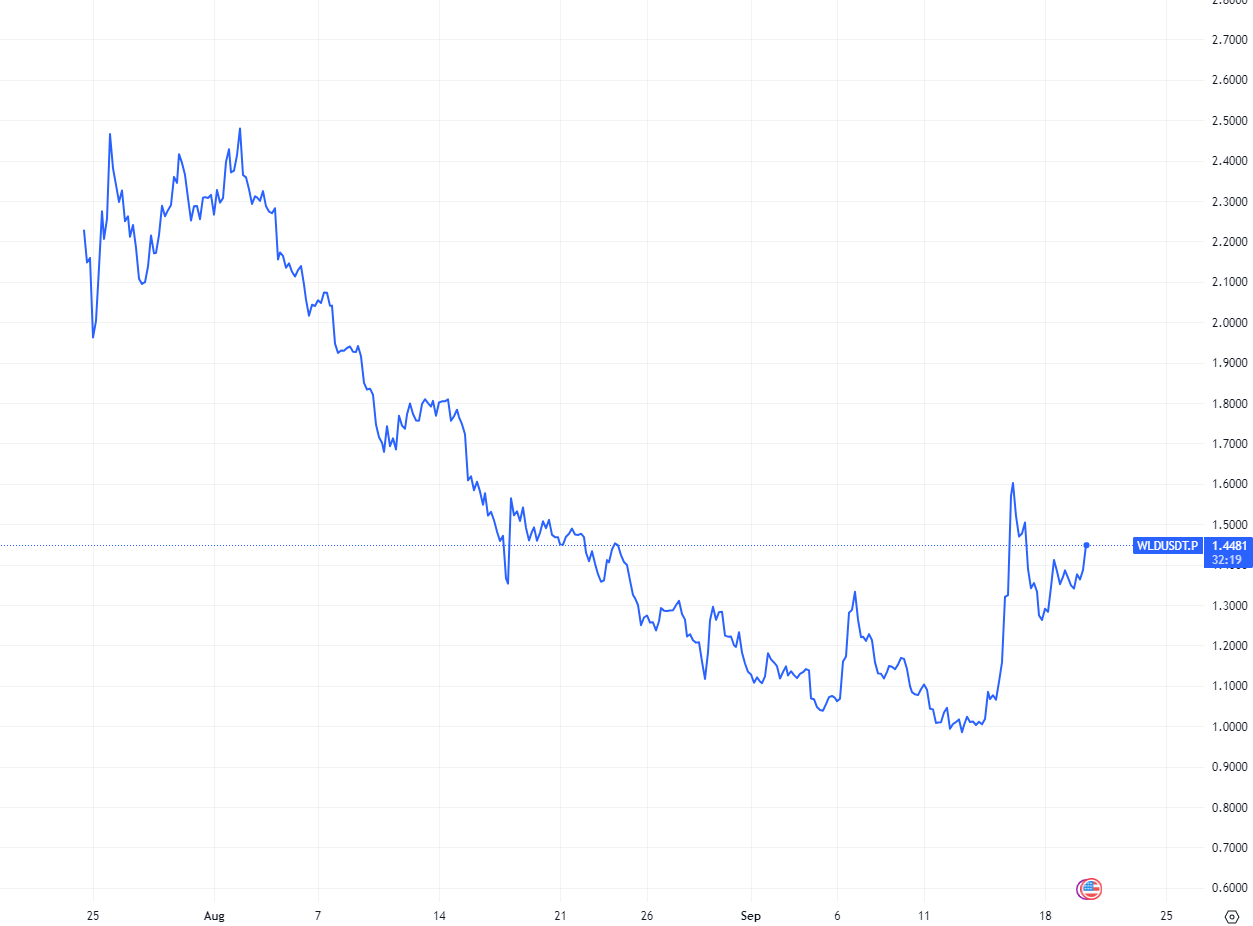

$WLD price action since USDT launch

This price decline has given credence to early critics' negative views on the project, which in our opinion, has led to a self-fulfilling sentiment echo chamber.

Markets have a tendency to push prices to levels where most get hurt. In the case of Worldcoin, there will be a significant amount of pain for short-sellers on any move higher. There’s currently over $55m in notional open interest in the $WLD token, representing close to 30% of its circulating market cap of $187,000,000. This makes the market vulnerable to a short squeeze should momentum begin to build, or a catalyst for price appreciation emerge.

Market Maker Agreements

A catalyst in crypto is any event or news that has the potential to cause a significant change in the price. Catalysts can be positive or negative and can come from a variety of sources such as listings, upgrades, regulatory changes, or partnerships. They can also be more discreet and in this case - structural.

On launch, WorldCoin signed market-maker agreements with several exchanges. The actual agreement was structured as follows:

“Collectively, the five entities have received loans of $100m $WLD for a time period of 3 months after the token launch. At the end of the three months, each entity must return its loan or alternatively, it may elect to purchase any amount of tokens up to the loan amount it has received.

The price per $WLD for this purchase will be set according to the following formula:

2.00 + (0.04* X), with X being equal to (i) the amount of tokens being purchased, divided by (ii) one million”.

In plain English, the agreements give the market makers the following benefits:

Access to a large supply of WLD tokens at the price of $2.80.

Priority listing on the exchanges.

Reduced trading fees.

If we break this agreement down, what the Worldcoin team has given market-makers is a $2.80 call option on $WLD, with an expiry of October 24th, 2023.

Visualization of MMs $2.80c - Oct23

This provides these entities with huge financial incentives to push the price of $WLD higher into the agreement expirations. The strike price of $2.80 is over 90% higher than current prices, providing a large margin of error.

This unique setup in positioning opens up the potential for high volatility over the coming weeks, and we believe will offer opportunities to those traders able to get ahead and capitalize on moves.

Wrapping Up

Worldcoin's predatory tokenomics and questionable business model have made it a target for short-sellers, who are betting that the price of $WLD will fall. As a result, over $50 million in short positions have been built up in the token.

Market-making agreements are set to expire at call prices significantly higher than the current price. This provides a massive incentive to push prices higher into the agreement expiry date - October 24th.

In this context of consensus short positioning and a structural catalyst, we believe that $WLD could push higher in the coming weeks leading up to the October 24th agreement expiry. If short-sellers are forced to cover their positions, this could lead to a major medium-term squeeze.

Hashblock Capital is an independent Crypto research firm. We deliver actionable, institutional-grade analysis across listed tokens.

Follow us on Twitter for more insights, or join our email list to get real-time analysis on catalysts, events, and flows.